I added a post called ‘The Golden Age of Wine‘ to this site two years ago. It was the English version of a story for the Chinese edition of Wine Enthusiast in which I gave eight reason why consumers have it good in this country. Are things that bright in 2016?

I’ve posted the original points below followed by comments on today’s scene. (Note: A version of this post appeared in my free China wine e-newsletter last week. Sign up for the newsletter here.)

The Golden Age of Wine

THEN: “This past year saw wine imports grow by baby steps instead of giant leaps. Warehouse shelves creak beneath the weight of unsold stock. Austerity measures sharply cut the big entertainment budgets of officials. Key Chinese producers struggle to maintain market share.”

“A forecast of gloom and doom hovers over the wine sector in China. But the silver lining of this cloud comes in the form of an oft-ignored force: consumers. In fact, one might argue they are in a golden era, and an increasingly brighter one at that. Here are eight good things Chinese consumers are getting more of.”

NOW: Let’s look at the four key issues cited above:

1) Import growth: It surged ~38 percent last year both by volume and value–see this country-by-country breakdown–and that has helped to reinvigorate the wine scene.

2) Unsold stock: While concern remains about the gap between how much wine is imported and how much ends up in consumer hands, there seems to be a general sentiment that a good deal of stockpiled wine was moved over the past two years.

3) Austerity campaign: When it began three years ago, few imagined the measures would last this long, but slashing luxury goods spending by officials, including on pricey bottles, helped to speed development of a consumer-based wine market.

4) Market share: Chinese producers continue to face a rising wave of decent and inexpensive imported wine and have lost share over the past two years.

As for gloom and doom, there are lots of concerns about the China wine market, but at the very least we have one that is more competitive and that many distributors and retailers describe as real and sustainable.

THEN: “1. Value: Thousands of new importers and distributors joined the field over the past five years in a belief that selling wine would be an easy win. Instead, it turned out to be tougher than uncorking a bottle with your teeth. We have too many players and, in turn, too much wine in the game. Companies must now redouble their efforts to appeal to those still opening their wallets and purses. And given the government’s austerity measures, this more than ever means consumers at large. That should translate into lower prices and better value.”

NOW: While many importers and distributors fell by the wayside, there is no shortage of newcomers joining the industry. The shift in focus to regular consumers, who spend less per bottle, has meant more demand for better quality at lower prices.

There were concerns then that we would see huge stockpiles of wine of poor quality–due to excessive age or poor storage conditions–getting dumped on the market. I haven’t seen any stats on the situation but have spotted some–not many, but some–dodgy products in retail outlets and restaurants.

THEN: “2. Price-checking: Just as important, consumers are better armed to discern that value. They might once have stood in a shop or supermarket aisle, faced a shelf of French wine and not known if that rmb300 bottle was fairly priced or some ridiculously marked up plonk. With the smart phone era, people can check brands, prices and tasting notes and much more on the spot or even at home before they buy. The options range from international sites like Wine-Searcher, which put prices into a global context, to Chinese-language applications like Wochacha that help reveal whether a bottle is a bargain or a bust.”

NOW: Consumers continue to be empowered by an ability to check prices. Some distributors are seeking higher margins by creating their own labels or using products only for certain channels like business to business, thus making it harder to crosscheck. But the pressure on margins continues, including from an online wine sector that is driving down prices and becoming more powerful by the month.

THEN: “3. Choice: China and its billion-plus consumers remain the world’s most enticing wine market. That translates into an amazing range of wines. From Albarino to Zinfindel, Argentina to New Zealand, cheap plonk to trophy wines, we find bottles from most every producing nation, grape variety and price range. Importers like ASC, Summergate and Torres carry hundreds of wines from over a dozen nations, while niche suppliers focus on particular regions (such as Burgundy or Napa), nations (such as Spain or South Africa) and even styles (such as cool climate wines). To give an example, consumers in Beijing can walk into a branch of imported goods shops like Jenny Lou’s or April Gourmet and find hundreds of wines, a large number priced at less than rmb100.

NOW: Choice continues to be excellent in places like Beijing and Shanghai and is steadily growing throughout the country as the wine scene grows in smaller and more remote cities. Powerful online platforms provide wine access where bricks and mortar operations do not. We also see lots of niche importers, managed by people who know their stuff, continue to pop up, including those focused on a single country or region or a specific category such as natural wine.

THEN: “4. Distribution: It is one thing to have lots of wine and quite another to get it into the hands–and mouths–of consumers. As slowly and surely as a spider weaves its web, distributors have crisscrossed the nation with networks. Aussino can share its portfolio of over 500 wines, and facilitate wine dinners, with its more than 100 retail outlets, clubs and restaurants–many of them franchises—throughout China. Most major importers have offices scattered around the country and an ability to deliver reliable brands most anywhere. From hypermarkets, supermarkets and corner stores to websites like generalist Taobao, wine-specific YesMyWine and even clubs and restaurants like M1NT and Temple, it is easier than ever for consumers to get wine. Need something cheap and decent at 4 AM? If you are close to a 7-ELEVEN in Beijing, grab a bottle of Concha y Toro for rmb70.

NOW: The big story of the past two years is online sales, with general platforms like Taobao and JD.com as well as wine-focused ones like YesMyWine and WangJiu helping spread wine far and wide. Some smaller and niche players have struggled–M1nt has closed and TRB is taking a short break–but there are more ways than ever for consumers to get their hands on wine

THEN: “5. Information: Wine is intimidating enough without having to read about it in a foreign language. That makes the rapid rise of Chinese-language information crucial. Publishers like Wine Enthusiast are delivering more of it than ever to consumers, particularly via the Internet. But it goes beyond that. The rise of social media means word-of-mouth is also helping consumers. A group of your friends posted about a bottle of particularly zesty New Zealand Sauvignon Blanc they loved? Within seconds you can find out where to get it, too. In a country as wired as China, this underscores the growing power of consumers.

NOW: Social media, including the massively influential weixin application, have only grown in importance, not only as ways to get expert info from winemakers, sommeliers and distributors but also to get recommendations from friends. The growing number of wine professionals–the WSET scene is booming–is paired with a rising amount of information. Hard copy publications have struggled, with Wine Enthusiast ending its Chinese-language version and, more recently, the sommelier-focused Pinor giving up print, but the overall wine info scene is thriving.

THEN: “6. Privacy: Also taking the intimidation out of wine are online retailers. Rather than have a restaurant waiter or shop clerk stare and make you worry about picking the “right” bottle, you can investigate wines at your own pace and get them delivered at home. Prices are competitive, the choice is impressive and the product ends up in your hands without anyone around to question why you are interested in comparing Merlot from France, the United States and Romania. It is easier now to “do your own thing“.

NOW: This is still the case and is invaluable during a time when a growing niche of consumers are experimenting with wine and discovering tastes and preferences.

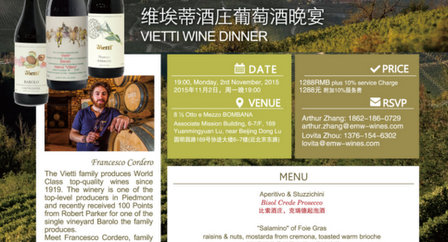

THEN: “7. Access: Superb value is available via dinners with visiting winemakers. While retail prices in China tend to be high, due to nearly 48 percent in tariffs and duties on most wines, events feel almost subsidized. Consider a boozy five-course dinner at a five-star hotel with famed German heavyweight Ernst Loosen. I’ve seen that one advertised for rmb388. In some parts of the world, such dinners would be far more expensive and might require good connections to get a seat. In China, distributors must often work to fill 30 seats in a city of millions. Even better, we see more such events in smaller and more remote cities. Take advantage while it lasts.

NOW: This also remains the case. Given that China’s market continues to attract the wine world’s attention, meeting personalities from every corner of the globe is still relatively easy. Even better, more of these people are venturing beyond key cities like Beijing, Shanghai, Guangzhou and Shenzhen.

THEN: “8. Local quality: Finally, while most of these benefits refer to imported wines, it is also important to note that we see much better wines being made in China. Grace Vineyard in Shanxi, Domaine Helan Mountain in Ningxia and Great River Hill in Shandong are among those making reasonably good products at reasonably good prices. A combination of quality inexpensive imports and greater consumer knowledge is putting pressure on Chinese producers to provide more quality and we see some local operations responding well to the challenge.

NOW: Quality continues to increase although concerns remain about the high prices of local wines, especially given the growth of reasonably good inexpensive imported wine. International attention to China’s local wine producers has also put a spotlight on the country’s weaknesses, such as poor vineyard management, although this will ultimately help the sector. Overall, the number of producers capable of making good wines is steadily rising and global interest in those wines has never been higher, although they still represent a relatively small part of China’s overall production.

THEN: “All of this is not to say the Chinese wine scene is a garden of Rose. Consumers still face relatively high prices, cheap wines passed off at exorbitant prices and plenty of sub-par local plonk, not to mention serious concerns about fakes. But the growing amount of wine choice, value and information provides golden opportunities for today’s consumer in China and hope for an increasingly bright future.”

NOW: Comparing then and now, I would argue that consumers still have it pretty good in China. Even the issue of high prices for imported wine is less of a concern as the new market reality, with a stronger emphasis on regular consumers, has meant a steady focus on rising quality and falling prices. As the online market expands, as the wine scene continues to grow in China’s smaller cities, and as taste becomes an increasingly important factor behind sales, we find ourselves in exciting times.

Check out the new online China Wine Directory. And if you’d like to get the free Grape Wall e-newsletter, sign up below.

Grape Wall has no sponsors of advertisers: if you find the content and projects like World Marselan Day worthwhile, please help cover the costs via PayPal, WeChat or Alipay.

Sign up for the free Grape Wall newsletter here. Follow Grape Wall on LinkedIn, Instagram, Facebook and Twitter. And contact Grape Wall via grapewallofchina (at) gmail.com.

Leave a Reply

You must be logged in to post a comment.