By Jim Boyce

A government crackdown on spending by officials. Reports from distributors that sales are tough. Widespread sentiment that warehouse shelves are creaking with the weight of unsold stock. Sounds like a wine market in trouble. So, naturally, the China Customs stats for the first half of 2013 show imports are… up?

Some might see this as evidence China is a bulletproof market. I’d caution against such a sentiment and instead suggest the bullet has yet to reach the target.

More imports do not mean more sales or, even less so, profits. And my best guess, based on talking to distributors and industry watchers, is that new importers – read: inexperienced ones – are still entering the market, that some imports might have been due –- I’m really not sure about this factor but it needs to be mentioned –- to fears China would put a tariff on European wine, and that some sales –- including on-line ones –- are at prices too low to make for a sustainable and profitable business. We may well see drearier numbers by year’s end as well as casualties among importers and retailers.

Happy thoughts! To the numbers…

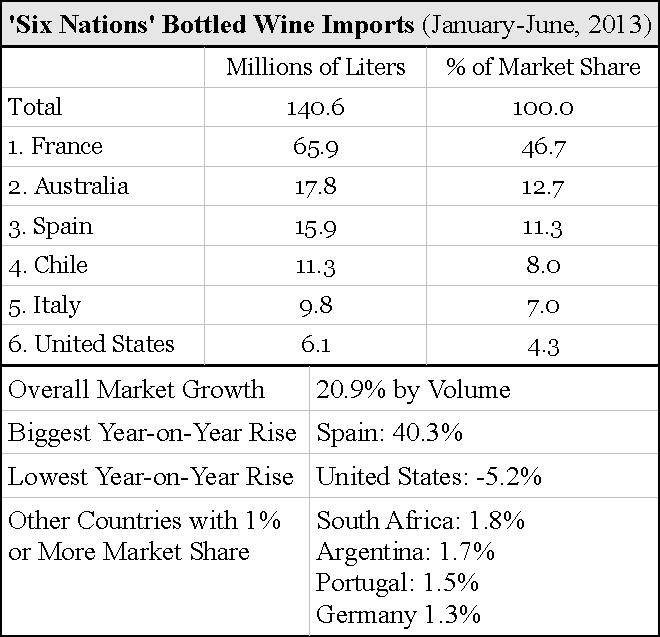

Bottled wine imports rose 20 percent by volume from January to June of 2013 compared to the same period in 2012. As usual, six nations — France, Australia, Spain, Chile, Italy and United States – accounted for ~90 percent of that. And, as usual, at least for most of the past two years, Spain led the charge, with 40 percent growth. The biggest underachiever: the United States with a decline of 5.2 percent. Overall, France remains dominant, with nearly 47 percent of the market, nearly triple its nearest competitor, Australia, with Spain inching ever closer to that second spot.

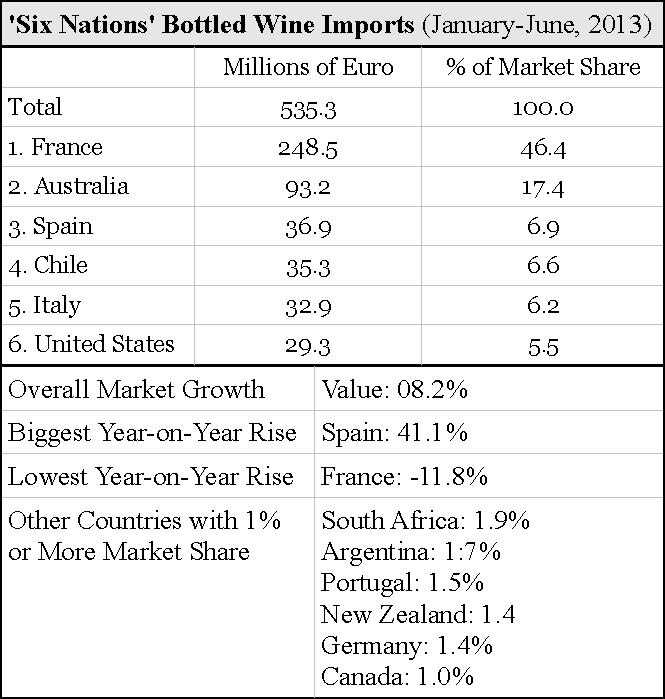

Value is another story. While France saw healthy growth of 18.9 percent by volume from January to June, the reported value of those imports dropped by 11.8 percent. No doubt people will point to that crackdown on official spending as meaning less fine French wine coming in. France nevertheless remains the leader by value, with nearly half of the market at 46.4 percent, and is far ahead of Australia in second place.

To its credit, Australia does much better in terms of value than of volume — 17.4 percent versus 12.7 percent. The third-biggest source of wine shows the opposite tendency. Spain accounts for 11.3 percent of imports on volume but a paltry 6.9 percent by value.

Finally, there are two minor players who hit above their weight in value. Both New Zealand and Canada represent less than 1 percent of the market by volume but at least that much by value (see below).

Note: These stats are accurate to the best of my knowledge. Hat tip to Tempranillo.

[This blog also sends out the free Grape Wall newsletter. Click here for a sample. To join the mailing list, use the form on the right of the blog or click here.

Grape Wall has no sponsors of advertisers: if you find the content and projects like World Marselan Day worthwhile, please help cover the costs via PayPal, WeChat or Alipay.

Sign up for the free Grape Wall newsletter here. Follow Grape Wall on LinkedIn, Instagram, Facebook and Twitter. And contact Grape Wall via grapewallofchina (at) gmail.com.

Leave a Reply

You must be logged in to post a comment.