(This story first appeared in Grape Wall newsletter. Subscribe for free here.)

The world might be struggling with excess wines and slow sales but Chinese producers are setting their sights on overseas markets.

We see more Chinese labels everywhere from London and Lima to Tokyo and Toronto to Singapore and Stockholm.

That includes from foreign-invested wineries like Ao Yun (LVMH), major producers like Changyu Moser XV and more modestly sized ones like Yangyang, Legacy Peak, Puchang and Canaan.

Winery reps are helping by heading abroad for promotion. At one time, this was mostly done by mega producers. But in the past dozen years, more mid-sized operations are following, with Ningxia wineries particularly active in teaming up for trips, including to Japan, France and Singapore this year.

And now we see smaller producers—including roaming winemakers who traverse China to source fruit, rent equipment and create brands—going out and showing the world the diversity of wine grapes and styles arising in this country.

They bring everything from common commercial styles to quirky natural, orange, pet-nat et al wines.

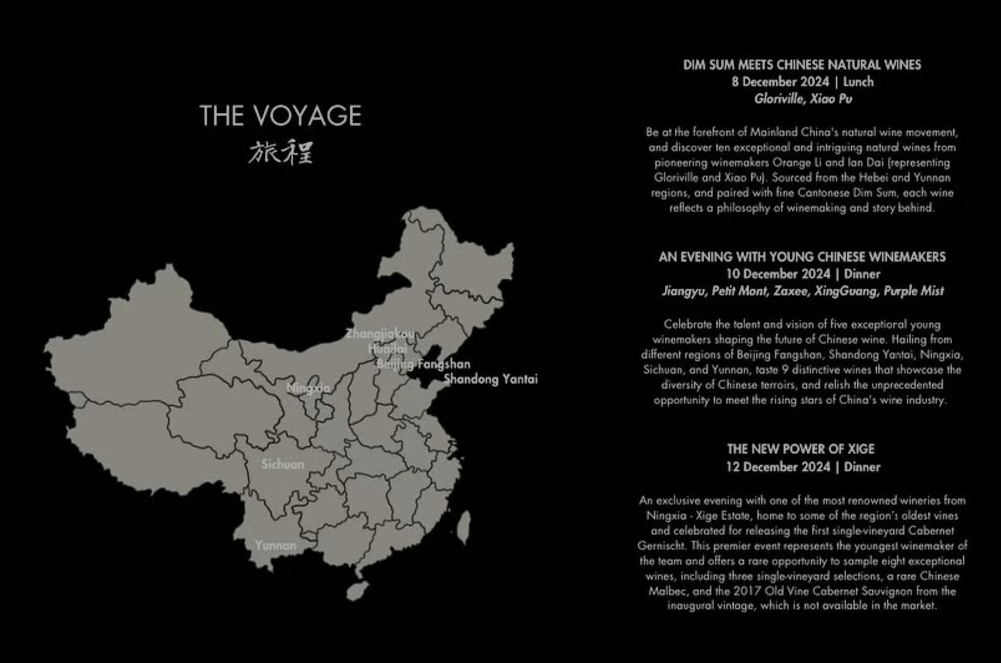

A bunch of these producers are in Singapore now for events with Andaz Hotel, most of them members of YGCW (Young Generation China Wine), a group generating much interest the past few years. (See my posts here and here.)

A driving force behind YGCW is Ian Dai of Xiaopu, a roaming winemaker active in at least six regions of China, including Yunnan, Hebei and Ningxia.

He partnered with Orange Li of Gloriville for a natural wine-focused lunch on December 8 and is slated to join reps from Purple Mist, Zaxee, Jiangyu, Xingguang and Petit Mont—the latter makes over two dozen wines from across China—for a dinner tonight, December 10.

A key factor here is Li Meiyu, who gained attention in the early 2010s by winning several major sommelier competitions in China. She honed her craft in Beijing, had numerous stints in France and the UK, and now is in Singapore.

Another factor is Singapore itself: along with Hong Kong and Macau, is a key hub for promoting Chinese wine from outside of continental China. Numerous wineries, including Fei Tswei (Copower Jade), Helan Qing Xue, Tiansai, Kanaan and Silver Heights have visited for tastings and promotions in recent years. You can find wines from many of these online there although their presence is quite small versus other wine-producing nations.

In any case, Dai has been indefatigable in crisscrossing China to promote his wine and has increasingly set his sights abroad. It’s part of an ambitious plan he explained in a Q&8 last year:

“I want to explore the potential of China. I’m 36 and I have maybe another 15 years in which I can travel pretty freely to wherever I want. I still have this chance to build a region, to grow something by myself, and then to make it shine on the international stage.”

(See “Ian Dai on Chinese terroir, niche wines & global dreams.”)

And Singapore is not a one-off. In recent days, four Xiao Pu wines were featured in a four-hour tasting at Arden Gardens Shopping Centre in Melbourne, including The Gathering, a red blend from Ningxia, and Tangerine, an orange Chardonnay with a week of skin contact and then barrel aging.

Dai also crossed the border from Singapore to Malaysia this week for a tasting in Johor Bahru at Chaos Bar, which announced “Ian’s bringing 7 badass bottles to Malaysia for the first time” and that the wines “taste like a terroir rebellion.”

Nor is this a one-off for other producers spreading their wings.

Another example is Shandong-based Jiangyu, China’s only producer of Grechetto, with owner Martin Jiang telling me last year he was intent on exporting. Jiangyu was also one of two Chinese wineries—the other was the much larger Silver Heights—at the Road to Italy tasting by Wine to Asia and natural wine association Vignaioli e Territori in Mantua this year.

Of course, whether it be small, medium or large Chinese wineries, observers will want to know just how much wine is being exported (relatively little so far despite headlines of double-digit growth), whether or not people overseas buy them mostly as curiosities (that is certainly a factor) and how competitive they can be in a world flooded with value-for-money wines (price has long been a criticism of many China wines).

I’ll write more about those issues in future newsletters. But for me as a consumer, it is exciting to see these small boutique producers on the go, as they often make quirky wine with unique personalities and thus share a quite different side of the China wine scene.

Grape Wall has no sponsors of advertisers: if you find the content and projects like World Marselan Day worthwhile, please help cover the costs via PayPal, WeChat or Alipay.

Sign up for the free Grape Wall newsletter here. Follow Grape Wall on LinkedIn, Instagram, Facebook and Twitter. And contact Grape Wall via grapewallofchina (at) gmail.com.