Treasury Wine Estates hosted its official 2024 Penfolds Collection launch in Beijing, spearheading an Australian wine surge in China and raising hopes this can boost the general wine market. It also meant cold hard reality on a hot summer day of drinking big red wines. All that and import stats below.

(A version of this post first appeared in the Grape Wall newsletter. Neither this site nor the newsletter have sponsors or advertisers, thus if you find them useful and want to help with hosting and looming fees, please consider supporting via WeChat, Alipay or PayPal.)

Market Hopes

The lifting of tariffs on Australian wine in March raised hopes for a struggling China wine market. And no brand is more prominent than Treasury Wine Estates / Penfolds, which, as oft-noted, rivalled the import value of some key nations before the pandemic and tariffs hit.

As Australian wine surges into China—see stats below—Penfolds has been organizing tastings, parties and dinners countrywide, promoting specific wines such as Bin 389, Bin407, Bin 707 and Grange, and reaching out to a wide range of KOLs and consumers.

The TWE team came to Beijing thus month for the China launch of the 2024 Penfolds Collection. I joined a “master class” that inspired insights into how Penfolds might retake market share.

Many messages are involved. Penfolds’ 180th anniversary. The new collection of wines. Penfolds offerings from China, France and the United States. And efforts to promote Chinese wine overseas.

Down Under Wines Up

First, some numbers. Recent months have seen Australia reeling in France in terms of bottled wine imports.

For the first half of 2024, Australia ranked fourth by volume at 7.5 million liters / 10% market share, behind France (23.6 m / 31%), Chile 20.4 m / 27%) and Italy (8.1 m / 11%).

But Australia shines for value, ranking second with USD166 million / 25%, behind only France (USD253m / 38.5%) and already double Chile (USD82m / 12.5%).

And when it comes to declared value per liter, Australia is the runaway winner at USD22, followed by the United States at USD11.1, France at USD10.7 and New Zealand at USD9.4.

When we only consider June, Australia is first in volume, with its 4.9 million liters ahead of France at 4.7m, Chile at 3.9m and Spain and Italy at 1.5m and 1.4m. And it also easily wins for value, with USD103 million, followed by France at 43.5m, Chile at 15m and the United States at 11.5m.

Long story short, we see a surge of Australian wine, particularly pricy bottles. And the story goes beyond TWE. I’ve already covered De Bortoli. I saw that an acquaintance received a major John Duval shipment last week. And so on. But Penfolds definitely draws the attention.

The East Is (Still) Red

The class was led by chief winemaker Peter Gago, who blended technical details, historical anecdotes, oft-told quips, stunning photos and support for Chinese wine (see below), all with simultaneous translation in the spacious confines of a Waldorf Astoria ballroom.

Leading a sprawling room of attendees through nine wines while fielding questions in a mere hour is no easy feat. Talk about efficiency.

In any case, I’ve written about the diversification of wine in China, namely, that we see a growing range of wine styles and grape varieties, both imported and locally produced.

Thus, the Penfolds lineup felt like a flashback to 2014. Of the nine wines, one was white—that old standby Chardonnay—while the reds focused on familiar varieties Shiraz and Cabernet Sauvignon.

The reds showed the ripeness and fruitiness and intensity and tannins of Penfolds “house style.” Consistent. Dependable. Easily discussed and commodified in terms of “Bin’ numbers.

Such characteristics helped make Penfolds a favorite for banqueting / entertaining and among consumers who might not know a lot about wine but sought a reliable well-known brand. In some ways, these wines are like elite baijiu and whisky brands—think Moutai and Johnnie Walker—where familiarity, consistency and status breed respect and sales.

And although banqueting / entertaining has cooled in recent years, it remains a significant and lucrative niche with a relatively high price per bottle, one where Penfolds exceled in the past.

Given all this, it’s a logical first step in rebuilding market share. After all, what else is Penfolds supposed to do given such red wines are its bread and butter. And given TWE has other labels with which to appeal to different niches within China.

Of course, retaking market share and growing the market are very different, and whether these red styles can boost overall interest is a crucial issue. I will address that existential / macro issue in a separate post.

China Focus

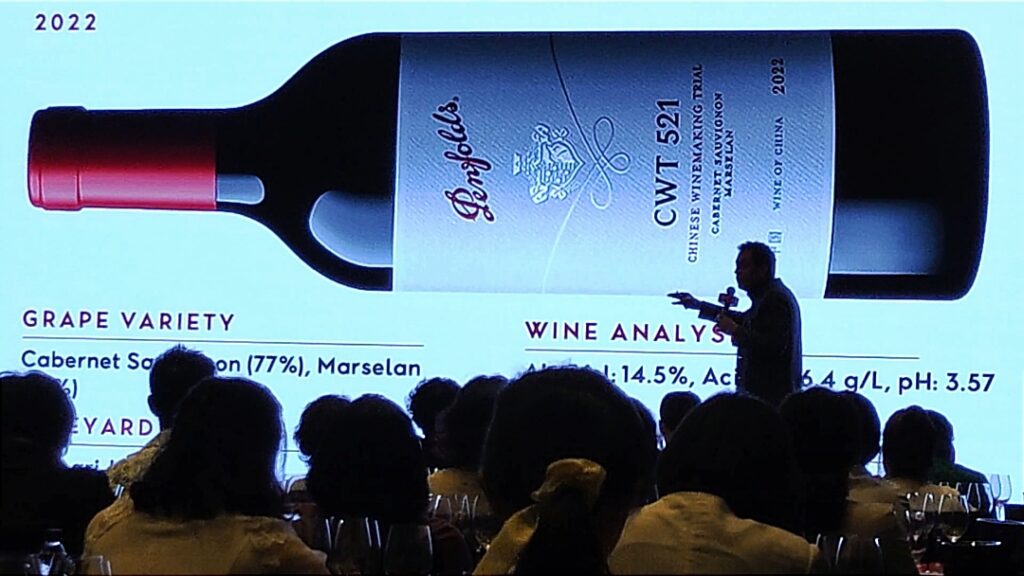

There was also a strong focus on promoting China during the master class. That includes Penfolds’ made-in-China wine CWT521—China Winemaking Trial 521—the first red presented.

This wine feels like a marketing challenge. The mission: “Take China’s most prolific region, Ningxia, and its most promising one, Shangri-la in Yunnan, and make a new wine with the country’s most common grape, Cabernet Sauvignon, and its quickly emerging one, Marselan.”

That’s four ways to generate some buzz! The result is 77% Yunnan Cabernet Sauvignon and 23% Ningxia Marselan.

Gago stressed several times this wine was being presented at 2024 Penfolds Collection launches in other nations, thus helping to promote China.

“We are showing learned [wine] journalists around the world your wine,” said he.

And he drew an analogy between Australia and China, saying that Shiraz in his country fills out the mid-palate of Cabernet Sauvignon while Marselan plays the same role here.

Anyway, this strategy makes sense given that in 2022 TWE made a “long-term, multi-faceted strategic co-operation agreement” with China Alcoholic Drinks Association, the organization spearheading tariffs on Australia, to “work together to build China’s fast-growing wine industry capability.”

As I wrote then, “Australia’s leading producer, Treasury Wine Estates, is not only making a version of its leading brand Penfolds in China but also aims to eventually sell it globally, which would further buoy the reputation of China as a producer.”

Finally, Gago mentioned the number 8, lucky in China, several times. The first vintage of St. Henri Shiraz, for example, was in 1888. That’s three eights! The total of the numbers in CWT521—5+2+1—is 8. And so on. (The tasting itself was being held on the eighth day of the eighth month.)

This is also something more common a decade or more ago, when some Bordeaux producers would use the number eight, the color red and / or Chinese imagery and characters to make cultural connections to consumers. Given Penfolds’ appeal with banqueting and gifting crowds, I guess it makes some sense.

House Recipes

Another notable message concerned staying true to Penfolds “house style.”

The peculiarities of a given vintage and its weather, a concern of so many wineries, seem less of a focus at Penfolds where the human hand can utilize multiple regions, grape varieties, barrel sources et al to smooth things out and achieve that style. It’s kind of a numbers game: the percent of each grape variety in a given year’s blend, the duration spent aging the wine in each kind of barrel and so on to reach that desired mark.

Again, this makes sense for a consumer niche seeking consistent quality much as they might what leading whisky and baijiu. And for many such buyers, generally big spenders, it is also a numbers game, from the digits of a particular “bin” to the score of a major critic to the price from a distributor

Global Portfolio

Finally, we also tried two other non-Australian wines: a French Cabernet-Petit Verdot-Merlot, which is still in the “winemaking trial” phase (FWT 585), and a Californian Cabernet-Shiraz, which has graduated to bin status (Bin 600).

The reputation Penfolds built with its Australian wines opens the door for these newcomers. I believe that is appeals to consumers who already trust Penfolds but seek something from France or the United States, though I wonder how much wine aficionados will be moved by such products.

(Penfolds has other non-Australian wines, too, including the “One” series. That includes a wine each from China, France and the United States, with the labels featuring a representative animal from each country and seemingly aimed at younger consumers. I’ve seen these pop up in numerous places the past few years, from trade fairs to Beijing convenience stores to the Drink magazine awards.)

In any case, the class was one of many recent events hosted by TWE across China, including in the capital, where Penfolds took over a top venue, Temple Restaurant Beijing, nestled in a temple complex a short walk from the Forbidden City. Penfolds’ logo and colors were a prominent part of the restaurant decor and the temple grounds’ art for a VIP dinner.

(TRB also hosted the Ningxia Winemakers Challenge finale I helped organize in 2014 and the interviews for a Netflix episode on Chinese wine. It’s a great location.)

In any case, the China market changed a great deal between the start of the pandemic / tariffs and this summer of 2024. And while it is unclear to what degree Australia and Penfolds can retake let alone increase their past wine market share—one Penfolds distributor told me that sales so far are “so-so”—it won’t be for a lack of effort.

I wanted to end by saying that Penfolds is back in China but the reality is the company remained active here throughout the pandemic and tariffs with organizing product launches, working with KOLs, selling its non-Australian wines, awarding scholarships at Chinese universities and making wines. It’s better to say Penfolds is back—in force.

[Support Grape Wall here. Follow on LinkedIn here. Check out Grape Wall blog here.]

(Get the free Grape Wall newsletter here. Follow on LinkedIn, Instagram, Facebook and Twitter. Grape Wall has no sponsors: help support the mission, including World Marselan Day via PayPal, WeChat or Alipay. Contact Grape Wall at grapewallofchina (at) gmail.com.)

Leave a Reply

You must be logged in to post a comment.