I’ve been super busy lately so I’ll be doing catchup these next few weeks, including posts on TWE’s made-in-China Penfolds, how the COVID-19 pandemic is revealing true wine prices to consumers, the continued drop in local wine production, World Marselan Day 2022 (the parties in Beijing and Shenzhen were good), why we had no Huailai wines at those events (that story isn’t so good), and more.

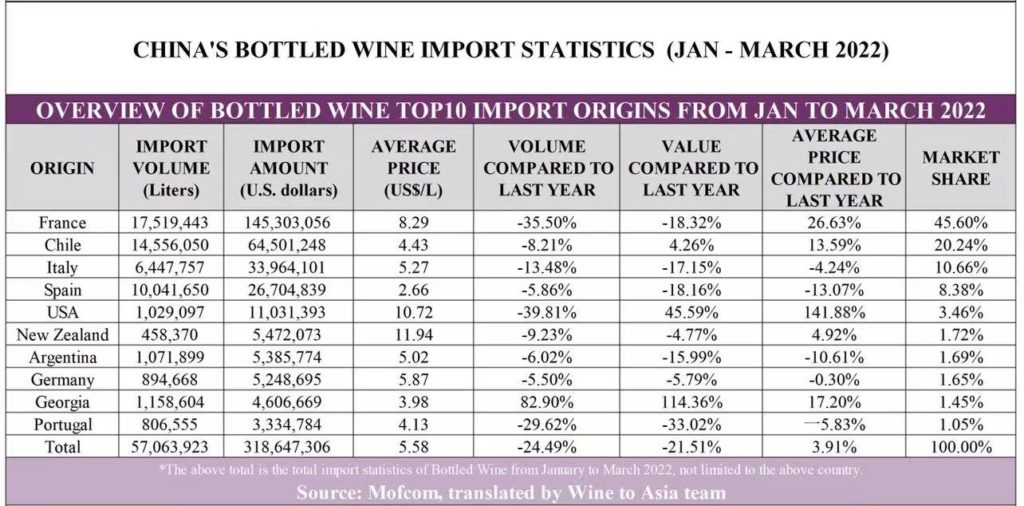

But first, here are the bottled wine import stats for the first quarter of 2022, the Wine to Asia edition. And once again, we see overall volume and value falling (see below).

As usual, caution is warranted when examining such a small sample size. For example, the crazy good performance of Georgia — up 83 percent by volume and 114 percent by value — appears be due to a single major shipment arriving.

And what wine is arriving does not tell us what wines are selling or are stuck in warehouses or on store shelves. As noted in this recent Q&8, “even before Australian wines faced higher taxation in early 2020, it was known there was a lot of stock here at all price ranges. Imports have almost stopped but there are still so many Australian cheap wines sold in the market even now.”

Plus, there are complications from the pandemic: a rise in shipping costs and delays, consumer concerns about spending on luxury goods, restrictions on dining and drinking in restaurants, bars et al cutting off key sales points, and so on.

But what is notable is the the continued downward trend in imports. And, based on what I’ve seen, the overall poor performance of wine, including versus competing niches such as spirits, cocktails and beer.

Anyway, with Australian virtually out of contention, France continues to stay in the top spot, with Chile — and its free trade agreement — in second. Italy and Spain follow, but have less import value — and only slightly more import value — combined that Chile.

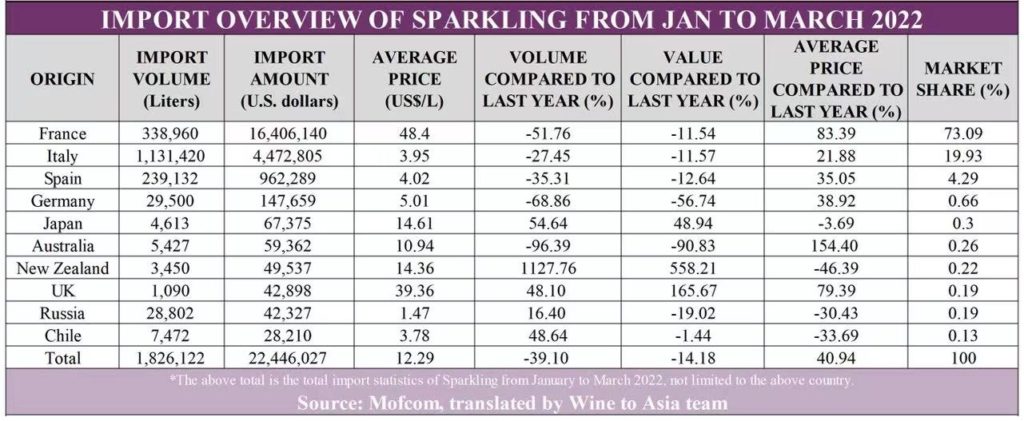

For those into bubbly, volume dropped 39% while value offered a better story with a decrease 14%. This is mostly a reflection of France — 52% and 12% respectively — which dominated with a 73 percent share. And it looks like New Zealand sparkling wine producers are finally make their big move, with volume up more than 1100 percent.

Grape Wall has no sponsors of advertisers: if you find the content and projects like World Marselan Day worthwhile, please help cover the costs via PayPal, WeChat or Alipay.

Sign up for the free Grape Wall newsletter here. Follow Grape Wall on LinkedIn, Instagram, Facebook and Twitter. And contact Grape Wall via grapewallofchina (at) gmail.com.

Leave a Reply

You must be logged in to post a comment.