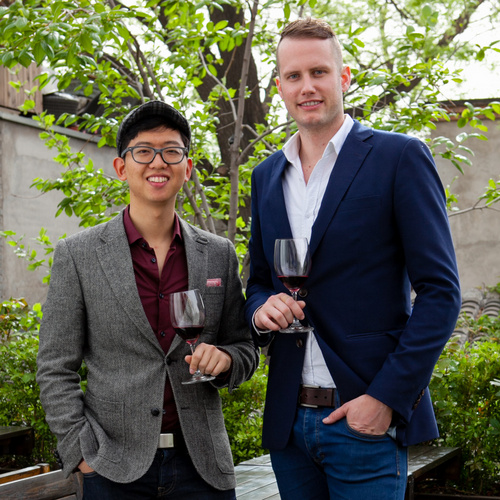

Ross Tan and Nick van Leeuwen of Australian Natural have spent most of their first year in business relentlessly promoting their organic and biodynamic wines in China. Here is a quick and dirty earthy interview about their organic wines and their views of the market.

How would you explain organic wine and biodynamic wine in one sentence each?

Nick: Organics contrasts with “industrial†or “conventional†practices by prohibiting any use of synthetic chemicals or artificial fertilisers in the vineyard or any chemical additives–other than minimal sulphur dioxide–in the winery.

Ross: Whilst organics is about what growers cannot do, biodynamics goes further and also prescribes what they should do, in order to holistically maximise soil health and ecosystem balance, with an additional aspect involving the rhythmic influences of the sun, moon and cosmos, in a rather fengshui-y way.

Are these kinds of wines harder to ship to China?

Ross: Well, unless it’s explicitly labelled as preservative free, the majority of organic and biodynamic wines still have some sulphur dioxide added, although at much lower amounts than normal, where it can often be overused to cover other flaws and problems in a wine.

These sulphites are a preservative that help protect the wines during transportation and storage, especially against temperature fluctuations. As such, whilst our wines might be slightly more sensitive, transportation isn’t really much bigger of an issue than would be normally.

Nick: Yeah, I guess no matter what wine, the most important issue is always to clear customs as expediently as possible. Every importer’s nightmare is having their wine baked like a potato in a customs locker for a month or even longer during the middle of summer. Having a good grasp of the process and also a great import agent is really key.

You guys are a niche importer both by country and style. What is the key advantage and key disadvantage of that?

Nick: Genuinely organic or biodynamic stuff is, kind of by its very nature, premium wine, as it involves a higher amount of attentiveness during all parts of the process. So one disadvantage is the limit this naturally imposes on our price range. Right now, our cheapest offerings start at around 140rmb retail, which isn’t expensive, especially for what is, but it isn’t super cheap either. So we can’t really offer anything at that cheapest end of the market, which often has really good volume, especially nowadays.

Ross: Sometimes people are also specifically looking only for a wine that we obviously won’t or can’t have, like a Spanish Cava or a French rosé. Sometimes people might even have an active bias against organic or biodynamic wines, or Australian or New World wines in general. Although actually, people with these biases have ended up being a great opportunity—after having their preconceptions shattered after tasting, they always become our most passionate supporters!

Nick: On the other hand, one strong advantage in our portfolio’s limited breadth is that we have depth–of knowledge, quality and service–which less-focused importers simply can’t match. It also gives us authenticity and credibility, which are always important in China and too often lacking. A related advantage is that we are interesting and stand out in a very competitive market which, in the wake of Xi Jinping’s austerity program, is rather overcrowded with lacklustre offerings.

Ross: This being different has sometimes allowed us to score meetings with clients who are bombarded by importers and who otherwise wouldn’t have given us a second look! Obviously, once we get our foot in the door, it’s down to the actual quality and value of our wines to close the deal, but we are thankfully also pretty well-served there, too.

What do you see as your niches in terms of regions of the country, income levels and other demographics?

Ross: It’s a term used mostly for the fashion market, but we really see ourselves fitting within the growing “affordable luxury†segment of China’s consumer market. Our customers are generally white-collar professionals who are doing decently well, generally with salaries of 10,000 rmb/month upwards. I would say we skew comparatively younger, and also, more female, than average. Probably because these demographics are more likely to be open-minded and interested in exploring wines beyond the typical French reds, and to prize boutique products over the megabrands, rather than the reverse. They also generally have better understanding and awareness of sustainability and organics.

Nick: Up to now we’ve mainly been targeting Beijing, which is our “home crowdâ€, and dabbling a bit in Shanghai, but we are aiming at expanding to many more second- and third-tier cities across China in the coming year. In the end, the coastal provinces and capital cities are still, and will most likely continue to be, more developed, more cosmopolitan and wealthier, which means a better market for us.

What is the biggest lesson you’ve learned so far?

Nick: Always under-promise and over-deliver. Follow-up on any potential leads, because you never know which might end up being that whale. Also, cash flow, cash flow, cash flow!

Ross: Bureaucracy in China is a complex thing of beauty that should never be underestimated–or maybe that should be, overestimated. Proceed with patience, caution and optimistic pessimism.

What are your key goals over the next two years in terms of broadening your reach and your portfolio?

Nick: We would like to consolidate our presence within Beijing obviously, but also hopefully make some solid inroads into Shanghai. As I mentioned earlier, we’re also working heavily right now on building some solid partnerships with good local sub-distributors to help expand our reach into more second- and third-tier cities across China. At the moment, we are not so much interested in doing direct online retail for our wine, although within Beijing at least, TRB Wines are already carrying several of our wines in their online store.

Ross: Expanding our portfolio is something we are very careful and selective about. We always do multiple tastings up here with friends, clients and other industry experts, before deciding on anything. Last time we ended up selecting only four new wines from a pool of around sixteen candidates. Our plan is top out at around only eight wineries and twenty wines, no more. One of those wineries will probably be from New Zealand. Actually, Aussies and Kiwis are always doing things together, and most people can’t even tell our accents apart anyway!

Nick: Their Sauvignon Blanc and Pinot Noir ain’t half bad either. Beyond wines, we are currently also stocking rare organic honeys from Western Australia, and occasionally do some contract import and sourcing work for other food products. In the future, we are also looking to expand into importing Australian meats, also with a focus on high-quality and sustainability. Australian organic wine, honey and meat has a nice bit of synergy, we think.

Say a customer in Beijing is new to wine and you have one shot to impress them. Which wine would you recommend and why?

Tough question. Are they Chinese or a foreigner? Are they male or female? Is it summer or winter? How much are they looking to spend? Is it raining outside? What’s their favourite ice cream flavour? These are important details, Jim!

Seriously though, without knowing the details, I would probably recommend The Hedonist Shiraz. We’ve yet to try it on somebody that doesn’t decently like it. It’s rather undeniably delicious and very accessible, even for an inexperienced palate. At the same time, it has enough complexity and finesse that our hypothetical friend will still keep coming back for more even after they’ve become more experienced or, God forbid, snobbish about wine.

Nick: Yeah, I agree. The Hedonist Shiraz would be my recommendation too. A cracker wine, and also smack bang in the middle of our range, price-wise. Also importantly, especially for a new drinker, the bottle’s a beauty. The logo is this lovely pen and ink drawing of a contented pig.

Ross: Everybody loves the pig!

Note: In terms of retail, TRB Wine, Mali’s Wine Cellar and, as of later today, La Cava de Laoma carry Australian Natural products. In terms of restaurants and bars, see Temple Restaurant Beijing, Capital M, Jing-A Taproom and Pop-Up Beijing.

—

I publish a free China wine newsletter about once a month. Sign up below!

Grape Wall has no sponsors of advertisers: if you find the content and projects like World Marselan Day worthwhile, please help cover the costs via PayPal, WeChat or Alipay.

Sign up for the free Grape Wall newsletter here. Follow Grape Wall on LinkedIn, Instagram, Facebook and Twitter. And contact Grape Wall via grapewallofchina (at) gmail.com.

Leave a Reply

You must be logged in to post a comment.