By Jim Boyce

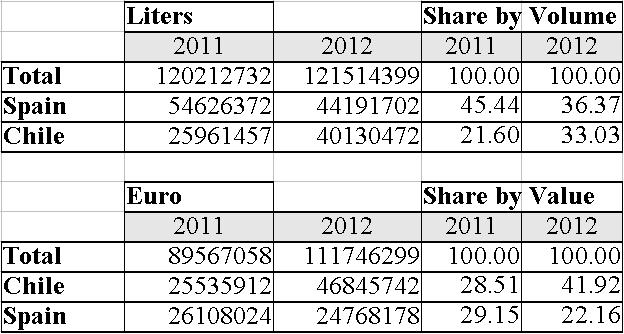

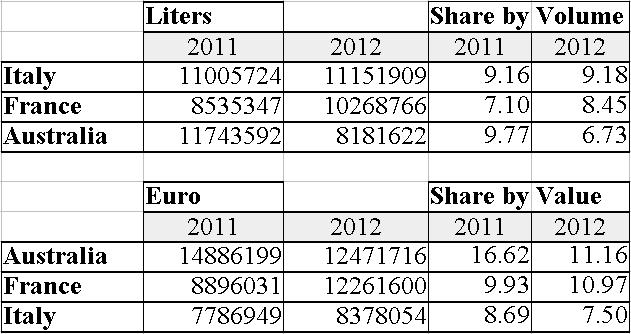

Chile and Spain dominated the bulk wine sector in China in 2012. Recentlyreleased Customs stats show the pair held 69 percent of the market by volume and 64 percent by value, with Italy, France and Australia rounding out the top five although all about five laps behind.

A comparison of the big boys reveals very different stories. Spain easily dominated by volume in 2011 but found itself neck-in-neck with Chile this year, taking 36 percent to its competitor’s 33 percent. The race was nowhere near as close in terms of value as Chile easily outperformed Spain, nearly doubling it with almost 42 percent of market share compared to its competitor’s 22 percent. Put another way, Chilean bulk imports were ~40.1 million liters at ~46.8 million Euro, or ~1.15 Euro per liter, while Spanish bulk imports were 44.2 million liters at 24.8 million Euro, or ~0.55 Euro per liter.

Only three other sources took five percent or more of the market in 2012 either by value or volume: Italy, France and Australia. The latter stands out by taking 6.7 percent by volume but 11.1 percent by value.

The United States and Portugal were the only other sources to have more than 1 percent of the market by volume or value, with Macedonia just under that mark in terms of value.

Back in ###, we saw plenty of news coverage about China claiming the wine industry in Europe receives unfair subsidies — see The Spain Drain: Is China at Threat from Cheap European Imports — and these numbers will provide even more fodder. At least by Customs reckoning, Chilean bulk is coming in at Draink:

Grape Wall has no sponsors of advertisers: if you find the content and projects like World Marselan Day worthwhile, please help cover the costs via PayPal, WeChat or Alipay.

Sign up for the free Grape Wall newsletter here. Follow Grape Wall on LinkedIn, Instagram, Facebook and Twitter. And contact Grape Wall via grapewallofchina (at) gmail.com.

wow, pretty good volume for spain but bad on value. hope spanish wineries can increase the price to sustain.