By Jim Boyce

Bottled wine imports have risen steadily, year after year, with France and Australia long the top two sources and Spain, Italy, Chile and the United States rounding out the “big six” that account for ~90% of the market. (For more details on the 2011 stats, see here).

The world of imported bulk wine is bit more turbulent. A few observations based on China Customs figures from 2011. (Note: This data was provided by an industry insider.)

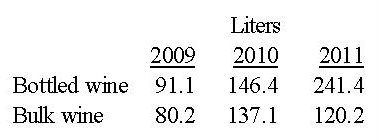

1. Bulk wine has fallen behind bottled wine. The gap was narrow in 2009 and 2010, with bottled wine slightly ahead, but it became canyon-esque in 2011. Last year, imports of bottled wine grew 64.9% while those of bulk wine shrank 12.3%, giving the former twice the volume of the latter: 241.4 million liters to 120.2 million liters.

There are many factors that impact imports of bulk wine, a great deal of which is destined to be blended with local wine and sold under domestic labels. A few of these factors are how many new vineyards come on line, the size of a given year’s grape harvest, predicted consumer demand and global bulk wine prices.

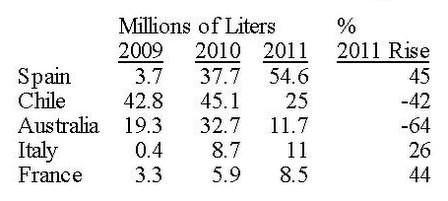

2. Five countries accounted for over 90% of bulk wine imports: Spain, Chile, Australia, Italy and France. There are major fluctuations with individual sources. Chile and Australia, the top two in 2009 and 2010, saw steep declines of 42 percent and 64 percent respectively in 2011. These translated into a total drop of more than 40 million liters. Meanwhile, Spain rose 45 percent in 2011, adding another 17 million liters to its total and giving it top spot. If you find that your local brand tastes more Spanish and less Chilean, that might be why.

Looking at it another way, as recently as 2009, when imported bulk wine totaled 80 million liters, Chile represented just over half while Australia took a quarter, thus giving the pair three-quarters of the market. Last year, when it totaled 120 million liters? Chile was just over 20% while Australia dropped to about 10%. Meanwhile, Spain has risen from 3.7 million liters in 2009Â to 54.6 million liters in 2011, a jump of almost 1500 percent, to give it just under half the market. Italy has also become a significant source, going from virtually nothing two years ago to 11 million liters in 2011.

3. Beyond the top five sources, both Portugal and Macedonia saw sharp gains from 2009 through 2011. Portugal went from 320,000 liters in 2009 to 2.88 million liters in 2011, while Macedonia went from zero to just over 1 million liters. As noted yesterday, both countries also showed strong gains in terms of bottled wine imports.

On the flip side, Argentina has virtually dropped off the bulk wine map, nosediving from 2.88 million liters in 2009 to a mere 87,000 liters in 2011. (An even more eye-popping stat: bulk wine from Argentina totaled 25 million liters in 2008!) This places it behind all of the countries mentioned above as well as the United States, South Africa, Germany, Bulgaria and Moldova.

Note: You can follow me on Twitter here, Facebook here or Weibo here.

(Hat tip to Tempranillo)

Grape Wall has no sponsors of advertisers: if you find the content and projects like World Marselan Day worthwhile, please help cover the costs via PayPal, WeChat or Alipay.

Sign up for the free Grape Wall newsletter here. Follow Grape Wall on LinkedIn, Instagram, Facebook and Twitter. And contact Grape Wall via grapewallofchina (at) gmail.com.

Leave a Reply

You must be logged in to post a comment.